The Global Battery Cost War: How Pricing Pressures Are Reshaping the Industry?

- valery_noryk

- Sep 3, 2025

- 3 min read

The global battery industry is entering a fierce cost war that will define the winners and losers of the electric vehicle (EV) transition. Falling raw material prices, China’s structural cost advantages, shifts in chemistry preference, and aggressive vertical integration are driving intense competition. At the same time, looming structural oversupply threatens to push margins even lower. Let’s explore the five forces shaping this new battleground.

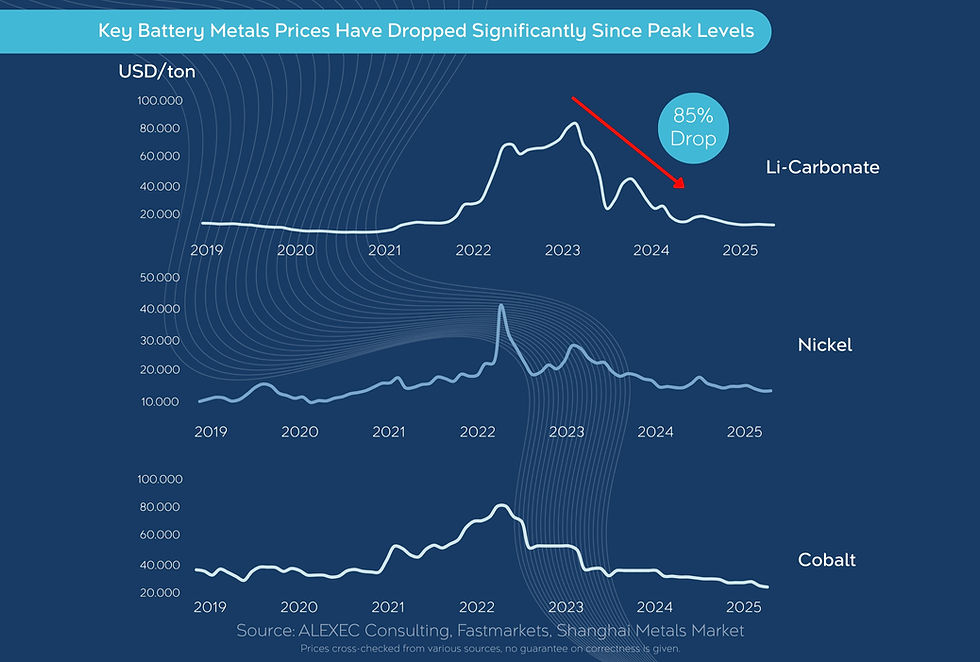

Material Cost Collapse as a Key Enabler of Price Cuts

The single most powerful driver of today’s battery cost reductions has been the collapse in material prices. Key inputs such as lithium carbonate, nickel, and cobalt have fallen by as much as 60–85% from their 2022–2023 peaks.

For chemistries like NMC (Nickel Manganese Cobalt), which rely heavily on these metals, the decline directly translates into lower cell costs. With raw material costs no longer spiking, manufacturers can finally pass on savings, triggering the current wave of battery price competition.

China’s Cost Advantage Driven by Labor and Supply Chain Proximity

China has cemented itself as the world’s battery manufacturing powerhouse, and cost advantage plays a central role. Proximity to upstream supply chains, lower labor costs, and massive economies of scale have enabled Chinese firms to achieve industry-leading production efficiency.

Chinese manufacturers are often able to deliver cells at prices significantly below Western counterparts, giving them the flexibility to dominate cost-sensitive markets. This regional cost differential will continue to shape the global battery war, especially as Western nations race to localize production.

Chemistry Shift: LFP Becomes the Standard in Cost-Driven Markets

Lithium Iron Phosphate (LFP) chemistry has rapidly become the preferred option for cost-driven EV and stationary storage applications. By 2024, LFP has captured a majority share of global production thanks to its lower cost, safety profile, and resource advantages over nickel-heavy chemistries.

While NMC cells still dominate in high-performance EVs demanding higher energy density, the battery cost war is increasingly being fought in the LFP space. China leads in scaling LFP, and this chemistry is rapidly gaining ground in Europe and the U.S., particularly for entry-level EVs and grid storage solutions.

Vertical Integration Unlocks Cost Control Across the Value Chain

To survive the battery price war, leading players are doubling down on vertical integration strategies. By controlling raw materials, refining, cell production, and even downstream assembly, manufacturers can protect margins and secure supply.

Companies that integrate upstream mining with downstream manufacturing enjoy significant resilience against market volatility. This integrated approach allows firms to balance costs across the value chain, strengthen bargaining power, and withstand the brutal price competition now gripping the sector.

The Battery Industry Is Heading Into Structural Oversupply

Despite booming EV demand, the battery industry faces a looming oversupply crisis. Gigafactories are expanding faster than demand growth, particularly in China. By 2030, even under an optimistic Net Zero Emissions (NZE) scenario, global demand is expected to utilize only 60% of installed capacity.

This imbalance is already visible in 2024, leading to intensified price pressure, consolidation, and heightened financial stress for weaker players. Structural oversupply ensures that the battery cost war is not just a short-term trend — it is the new normal.

Ready to Navigate the Battery Cost War?

The global battery cost war is reshaping the industry’s competitive landscape. Material cost collapses, China’s structural cost advantages, the chemistry shift to LFP, vertical integration, and looming oversupply are combining to drive unprecedented pricing pressure.

For industry stakeholders, the path forward requires strategic clarity, cost discipline, and smart positioning. Companies that fail to adapt risk being left behind in an unforgiving market.

At ALEXEC Consulting, we help clients understand, anticipate, and act on the shifting economics of the battery sector. Whether you’re an automaker, investor, or supplier, our insights and strategies can help you stay competitive in this high-stakes environment.

Comments